Exploring the world of investing in dividend-yielding shares in 2025, this guide offers a detailed look at the strategies and considerations involved. Whether you're a seasoned investor or just starting out, understanding how to navigate this landscape can be crucial for your financial goals.

As we delve into the nuances of dividend-yielding shares, you'll gain insights into key concepts, risks, and opportunities that can shape your investment decisions in the coming years.

Understanding Dividend-Yielding Shares

Dividend-yielding shares are stocks issued by companies that pay out a portion of their profits to shareholders in the form of dividends. These dividends are usually distributed on a regular basis, providing investors with a steady income stream.

How Dividend Payments Work for Shareholders

When you invest in dividend-yielding shares, you become a part-owner of the company. As a shareholder, you are entitled to receive a share of the company's profits in the form of dividends. The amount you receive is typically based on the number of shares you own.

Dividend payments can be made quarterly, semi-annually, or annually, depending on the company's dividend policy. Some companies may also offer special dividends in addition to regular dividend payments.

It's important to note that dividend payments are not guaranteed and can fluctuate based on the company's financial performance.

Comparing Dividend-Yielding Shares with Growth Stocks

Dividend-yielding shares are often favored by investors looking for a steady income stream and potentially lower volatility. These stocks are typically issued by well-established companies with a history of stable earnings and dividend payments.

In contrast, growth stocks are issued by companies that reinvest their profits back into the business to fuel growth. These stocks may not pay dividends, but they have the potential for higher capital appreciation.

Researching Dividend-Yielding Companies

When looking to invest in dividend-yielding companies, it is crucial to conduct thorough research to identify the most promising opportunities. One key aspect to consider is the financial health of the company, as this can directly impact its ability to maintain and grow dividend payments over time.

Key Metrics to Look for in Dividend-Yielding Companies

- Dividend Yield: This is the percentage of a company's stock price paid out as dividends annually. A higher dividend yield indicates a potentially attractive investment.

- Payout Ratio: The ratio of dividends paid out to earnings. A lower payout ratio suggests that a company has room to increase dividends in the future.

- Dividend Growth Rate: The rate at which a company's dividend payments increase over time. Consistent growth is a positive sign for long-term investors.

Importance of Company Financial Health

Maintaining a strong balance sheet, steady cash flow, and manageable debt levels are essential for companies that consistently pay dividends. A company with solid financial health is more likely to weather economic downturns and continue rewarding shareholders with dividends.

Industries Known for Offering High Dividend Yields

- Real Estate Investment Trusts (REITs): REITs are known for their high dividend yields due to the requirement to distribute a significant portion of their income to shareholders.

- Utilities: Companies in the utilities sector often offer stable dividend payments, as their services are essential and generate consistent cash flow.

- Consumer Staples: Companies that produce essential consumer goods tend to have stable earnings and cash flow, making them attractive for dividend investors.

Evaluating Dividend Yields

When considering dividend-yielding shares for investment, evaluating dividend yields plays a crucial role in making informed decisions. This involves calculating the dividend yield, understanding its significance in relation to share price, and comparing different dividend yield strategies for long-term investments.

To calculate the dividend yield of a stock, you can use the following formula:

Dividend Yield = (Annual Dividend per Share / Price per Share) x 100

Significance of Dividend Yield

Dividend yield reflects the percentage return an investor can expect to receive from owning a particular stock in the form of dividends. A higher dividend yield indicates a higher return on investment, which can be attractive to income-seeking investors.

Comparison of Dividend Yield Strategies

There are different strategies that investors can consider when evaluating dividend yield for long-term investments:

- High Dividend Yield:Investing in stocks with a high dividend yield can provide a steady income stream, but it may indicate that the company is distributing a large portion of its earnings as dividends, potentially limiting growth opportunities.

- Dividend Growth:Focusing on companies with a history of increasing dividends over time can be beneficial as it indicates financial stability and potential for future dividend growth.

- Total Return:Some investors may prioritize total return, which includes both capital appreciation and dividend income. This approach considers the overall return on investment rather than just the dividend yield.

Risks and Considerations

Investing in dividend-yielding shares comes with its own set of risks and considerations that investors need to be aware of. These risks can impact the overall returns on investment and the stability of dividend payments.

Economic Factors Impacting Dividend Payments

Economic factors play a crucial role in determining the stability and growth of dividend payments. Factors such as economic downturns, inflation, interest rates, and market volatility can all impact a company's ability to maintain or increase dividend payments. For example, during a recession, companies may struggle to generate enough profits to sustain dividend payouts, leading to potential cuts or suspensions.

- Companies heavily reliant on a specific sector or market conditions are more susceptible to economic fluctuations affecting dividend payments.

- Changes in government policies, regulatory environments, or trade agreements can also impact dividend yields.

- Global events such as political instability, natural disasters, or pandemics can have ripple effects on companies' financial health and dividend distributions.

Strategies to Mitigate Risks

To mitigate risks when investing in dividend-yielding stocks, investors can consider the following strategies:

- Diversification: Spreading investments across different sectors and industries can help reduce the impact of economic downturns on dividend income.

- Research and Due Diligence: Thoroughly researching companies' financial health, dividend history, and growth prospects can help investors make informed decisions.

- Focus on Quality: Investing in companies with a strong track record of dividend payments, solid cash flow, and sustainable business models can provide more stability in dividend yields.

- Monitor Economic Indicators: Keeping an eye on key economic indicators such as GDP growth, interest rates, and unemployment rates can help investors anticipate potential risks to dividend payments.

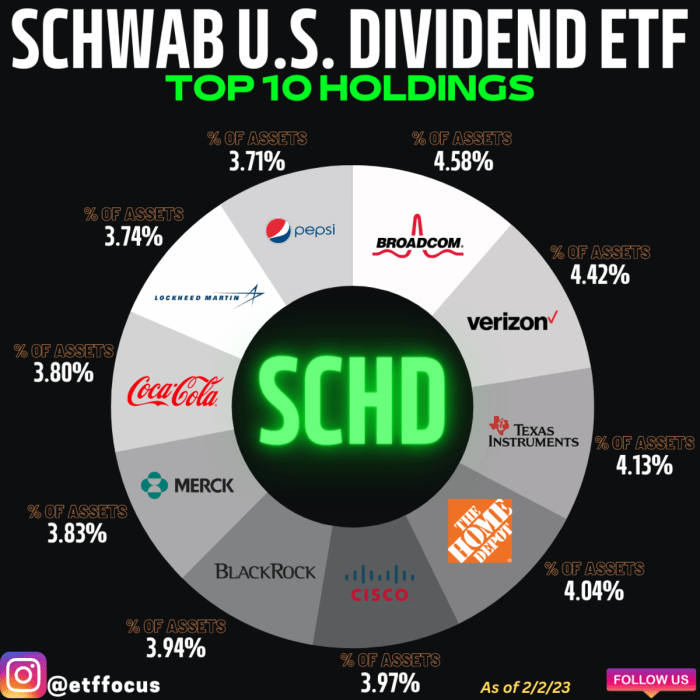

Building a Diversified Portfolio

Diversification is a key strategy in investing, especially when it comes to dividend-yielding shares. By spreading your investments across different companies and sectors, you can reduce the risk of your portfolio being heavily impacted by the performance of a single stock or industry.

This helps to protect your investment against market volatility and economic downturns.

The Importance of Diversification

Diversification is essential in mitigating risk in your investment portfolio. By holding a mix of dividend-yielding shares from various industries, you can ensure that the potential losses from underperforming stocks are offset by gains in other areas. This helps to create a more stable and resilient portfolio over the long term.

- Diversification reduces concentration risk

- It provides exposure to different sectors and industries

- Helps in minimizing the impact of market fluctuations

Balancing Dividend Stocks with Other Investments

While dividend-yielding shares can provide a steady income stream, it's important to balance them with other types of investments to achieve a well-rounded portfolio. Consider adding growth stocks, bonds, real estate, or other assets to diversify your investment mix and reduce overall risk.

Remember, a balanced portfolio not only includes dividend stocks but also growth-oriented investments for long-term wealth accumulation.

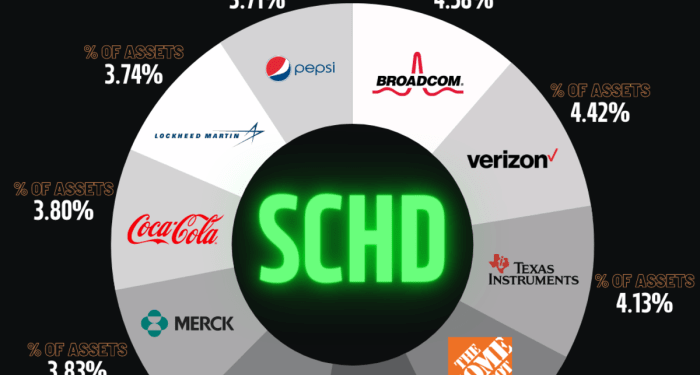

Examples of Diversified Portfolios

A diversified portfolio may consist of a mix of dividend-paying stocks from different sectors such as technology, healthcare, consumer goods, and utilities. Additionally, adding bonds or real estate investment trusts (REITs) can further enhance diversification and provide stability to your overall portfolio.

- Portfolio A: 40% dividend stocks, 30% growth stocks, 20% bonds, 10% REITs

- Portfolio B: 50% dividend stocks, 20% real estate, 20% index funds, 10% cash reserves

Final Review

In conclusion, investing in dividend-yielding shares in 2025 requires careful planning, research, and a diversified approach. By following the strategies Artikeld in this guide, you can position yourself for success in the dynamic world of investing.

FAQ Explained

What are dividend-yielding shares?

Dividend-yielding shares are stocks of companies that pay out a portion of their profits to shareholders in the form of dividends.

How do you calculate dividend yield?

Dividend yield is calculated by dividing the annual dividend per share by the stock price and multiplying by 100.

Why is diversification important when investing in dividend-yielding shares?

Diversification helps spread risk across different assets, reducing the impact of a single stock's performance on your overall portfolio.