Digital Marketing Agency for Financial Services: What to Look For sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Now, let's dive into the specifics of what to consider when selecting a digital marketing agency for financial services, the services they should offer, compliance and regulation aspects, and how to measure performance effectively.

Digital Marketing Agency Selection

When selecting a digital marketing agency for financial services, there are several important factors to consider to ensure the best fit for your specific needs. One of the key considerations is the agency's industry experience and expertise in the financial services sector.

This can greatly impact the effectiveness of the marketing strategies implemented and the understanding of the industry's unique challenges and regulations.

Significance of Industry Experience

Industry experience plays a crucial role in the selection process of a digital marketing agency for financial services. Agencies with a deep understanding of the financial services sector are better equipped to develop tailored strategies that resonate with the target audience.

They are familiar with the compliance requirements, market trends, and customer behavior within the industry, allowing them to create more effective campaigns that drive results.

- Experienced agencies can navigate the complexities of financial services marketing more effectively.

- They have insights into the competitive landscape and can identify opportunities for growth.

- Industry expertise ensures compliance with regulations and best practices specific to financial services.

Specialized Agencies vs. General Agencies

When choosing a digital marketing agency for financial services, you may come across specialized agencies that focus solely on serving clients within the industry, as well as general agencies that cater to a wide range of sectors. Each type of agency has its own set of advantages and considerations to keep in mind.

- Specialized Agencies:These agencies have in-depth knowledge of the financial services sector and can offer tailored solutions that align with industry-specific goals and challenges.

- General Agencies:While general agencies may lack the industry specialization, they can bring a fresh perspective and innovative ideas that could benefit financial services companies looking to stand out in a competitive market.

- It is essential to evaluate the agency's track record, case studies, and client testimonials to determine if their expertise aligns with your business objectives.

Services Offered

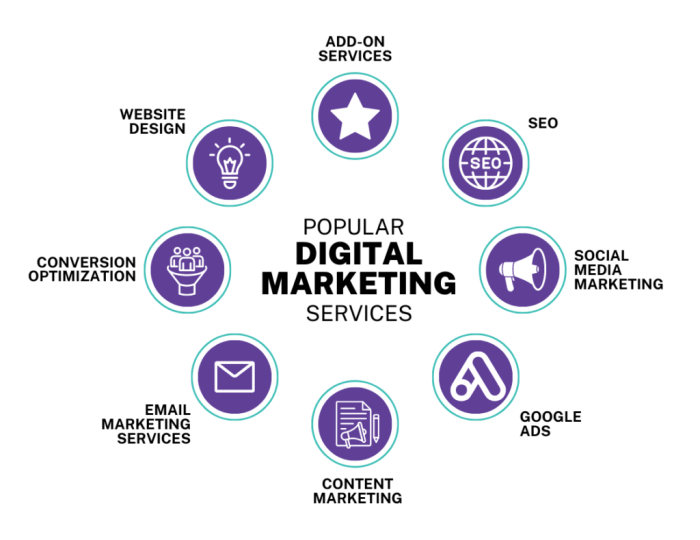

Financial services agencies should offer a range of digital marketing services tailored specifically to the industry. These services are crucial for effectively reaching and engaging with the target audience in the online space.

Key Digital Marketing Services for Financial Services

- Search Engine Optimization (): Optimizing website content to rank higher in search engine results pages, driving organic traffic and improving visibility.

- Pay-Per-Click Advertising (PPC): Running targeted ads on search engines and social media platforms to increase website traffic and generate leads.

- Social Media Marketing: Engaging with the audience on social media platforms to build brand awareness, drive website traffic, and foster customer relationships.

- Email Marketing: Sending personalized and targeted emails to nurture leads, promote services, and drive conversions.

- Content Marketing: Creating valuable and relevant content to educate and engage the audience, establish authority, and drive website traffic.

The Importance of Tailored Strategies for Financial Services

Tailored digital marketing strategies are crucial for financial services agencies due to the unique regulatory environment, competitive landscape, and complex nature of financial products. Strategies need to be customized to comply with regulations, address specific pain points of the target audience, and differentiate the agency from competitors.

The Role of Content Marketing in Promoting Financial Services Online

Content marketing plays a vital role in promoting financial services online by providing valuable information to the audience, building trust and credibility, and driving organic traffic through

Compliance and Regulation

In the digital marketing landscape for financial services, compliance with regulations is crucial to maintain trust and credibility. Financial institutions must adhere to strict rules and guidelines to protect consumer interests and ensure data security.

Regulatory Challenges in the Financial Sector

- Advertising Restrictions: Financial products and services are subject to restrictions on how they can be advertised to the public.

- Disclosure Requirements: Transparency in marketing materials is essential to provide accurate information to consumers.

- Data Privacy Laws: With the rise of data breaches, agencies must comply with data privacy laws to protect client information.

- Anti-Money Laundering (AML) Regulations: Agencies must implement AML measures to prevent financial crimes and ensure compliance with regulations.

Data Security and Privacy Compliance

- Secure Data Handling: Agencies use encryption and secure servers to protect sensitive client information from unauthorized access.

- Compliance Audits: Regular audits are conducted to ensure that data security protocols are up to date and in compliance with regulations.

- Employee Training: Staff members are trained on data security best practices to prevent data breaches and ensure compliance.

- Client Consent: Agencies obtain explicit consent from clients before collecting or using their personal data for marketing purposes.

Performance Measurement

In the world of digital marketing for financial services, measuring performance is crucial to determine the success of campaigns and optimize strategies for better results. By tracking key performance indicators (KPIs) and leveraging analytics tools, businesses can gain valuable insights into the effectiveness of their marketing efforts.

Key Performance Indicators (KPIs) for Financial Services Marketing

- Conversion Rate: This metric measures the percentage of website visitors who take a desired action, such as filling out a contact form or signing up for a newsletter.

- Cost Per Lead (CPL): Calculating the cost of acquiring a lead through marketing efforts helps in evaluating the efficiency of campaigns.

- Return on Investment (ROI): Understanding the return on investment from digital marketing activities is essential to assess the profitability of the strategies deployed.

- Click-Through Rate (CTR): Monitoring the CTR provides insights into the effectiveness of ad copy and creative elements in driving user engagement.

Utilizing Analytics Tools for Optimization

Analytics tools like Google Analytics and Adobe Analytics offer valuable data on website traffic, user behavior, and campaign performance. By analyzing this data, marketers can identify trends, optimize strategies, and make data-driven decisions to improve overall performance.

Closure

In conclusion, Digital Marketing Agency for Financial Services: What to Look For sheds light on the essential elements to keep in mind when choosing a digital marketing partner for financial services. With a focus on industry experience, tailored strategies, compliance, and performance measurement, businesses can navigate the digital landscape with confidence and success.

FAQ Resource

What factors should be considered when selecting a digital marketing agency for financial services?

Important factors to consider include industry experience, tailored strategies, and understanding of financial regulations.

How do agencies ensure data security and privacy compliance when handling financial client information?

Agencies ensure compliance by implementing secure data handling protocols, encryption methods, and following regulatory guidelines.

Why is content marketing important for promoting financial services online?

Content marketing helps establish credibility, engage audiences, and convey complex financial information in an easily understandable manner.