Delving into Digital Marketing Agency for Financial Services: What to Look For, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Exploring the essential aspects of selecting a digital marketing agency for financial services is crucial for success in the competitive landscape of today's financial sector.

What to Consider Before Choosing a Digital Marketing Agency for Financial Services

When selecting a digital marketing agency to promote financial services, there are several crucial factors that should be taken into account to ensure the success of your marketing campaigns. From industry experience to compliance knowledge, here are the key considerations to keep in mind:

Industry Experience

It is essential to choose a digital marketing agency that has a proven track record in the financial services sector. Look for agencies that have worked with clients in the finance industry and have a deep understanding of the unique challenges and opportunities in this field.

- Check the agency's portfolio to see if they have experience working with financial institutions, investment firms, or other related businesses.

- Ask for case studies or client testimonials to gauge the agency's success in delivering results for financial clients.

- Ensure the agency has a team of experts who are well-versed in financial services marketing and are up-to-date with industry trends.

Compliance and Regulatory Knowledge

Given the strict regulations governing the financial services industry, it is crucial that the digital marketing agency you choose understands and complies with these requirements. Failure to adhere to compliance standards can result in severe penalties and damage to your reputation.

- Verify that the agency has experience navigating compliance issues in the financial sector and can ensure all marketing campaigns meet legal standards.

- Ask about the agency's knowledge of regulations such as GDPR, SEC guidelines, and other relevant laws that impact financial marketing.

- Discuss how the agency plans to maintain compliance throughout the marketing process and mitigate any risks associated with regulatory violations.

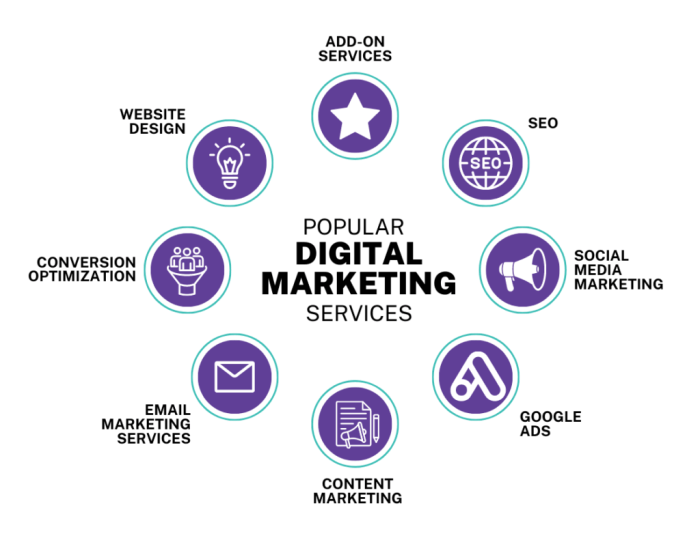

Services Offered by Digital Marketing Agencies for Financial Services

Digital marketing agencies specializing in financial services offer a range of services to help financial institutions establish a strong online presence and attract potential clients. These services are tailored to meet the unique needs and regulations of the financial industry.

for Financial Services

Search Engine Optimization () plays a crucial role in promoting financial services online by improving a company's visibility in search engine results. strategies help financial institutions rank higher in search engine results pages, driving organic traffic to their websites and increasing brand awareness.

Content Marketing in the Financial Services Industry

Content marketing is essential for financial services companies to educate and engage their target audience. By creating high-quality, informative content such as blog posts, articles, whitepapers, and videos, financial institutions can establish themselves as industry experts and build trust with potential clients.

Content marketing also helps improve search engine rankings and drive organic traffic to the company's website.

Case Studies and Success Stories

In the world of digital marketing for financial services, case studies and success stories play a crucial role in showcasing the effectiveness of different strategies. By examining real-life examples, we can gain valuable insights into how digital marketing agencies have helped financial institutions achieve their goals.

Example 1: Successful Social Media Campaign

- A digital marketing agency partnered with a financial services company to launch a social media campaign targeting millennials.

- The campaign utilized engaging content, interactive quizzes, and influencer partnerships to increase brand awareness and drive website traffic.

- As a result, the financial services company saw a significant increase in leads and conversions from the millennial demographic.

Example 2: Effective Strategy

- Another financial institution collaborated with a digital marketing agency to improve its search engine ranking through a comprehensive strategy.

- The agency conducted research, optimized on-page content, and built high-quality backlinks to boost the institution's online visibility.

- Following the implementation of the strategy, the financial institution experienced a substantial increase in organic traffic and higher conversion rates.

Example 3: Email Marketing Success

- A digital marketing agency worked with a financial services firm to revamp its email marketing campaigns and optimize customer segmentation.

- The agency implemented personalized email sequences, A/B testing, and automated workflows to enhance engagement and drive customer retention.

- As a result, the financial services firm saw a significant improvement in email open rates, click-through rates, and ultimately, customer satisfaction and loyalty.

Building Trust and Credibility

Building trust and credibility is essential for digital marketing agencies working with financial services clients. It helps establish a strong reputation and fosters long-term relationships with clients. Let's explore some strategies used by these agencies to build trust and credibility:

Client Testimonials

Client testimonials are a powerful way to showcase the positive experiences of past clients. By sharing success stories and testimonials from satisfied clients, digital marketing agencies can build trust with potential clients. These testimonials provide social proof and demonstrate the agency's ability to deliver results.

Industry Partnerships

Collaborating with reputable organizations in the financial services industry can also help digital marketing agencies build trust and credibility. By forming partnerships with industry leaders, agencies can leverage their expertise and reputation to enhance their own credibility. Clients are more likely to trust an agency that is endorsed by trusted industry partners.

Transparency and Ethical Practices

Transparency and ethical practices are crucial in digital marketing for financial services. Clients want to work with agencies that operate with integrity and are transparent about their processes and results. By being honest and upfront about their strategies, digital marketing agencies can build trust with clients and establish credibility in the industry.Overall, building trust and credibility is a continuous effort for digital marketing agencies working with financial services clients.

By implementing strategies such as client testimonials, industry partnerships, and maintaining transparency, agencies can strengthen their reputation and attract more clients in the competitive financial services market.

Closing Notes

In conclusion, the discussion sheds light on the key considerations when choosing a digital marketing agency for financial services, emphasizing the need for expertise, tailored services, and credibility in this specialized industry.

User Queries

What factors should be considered when choosing a digital marketing agency for financial services?

Factors to consider include industry experience, compliance knowledge, and a track record of successful campaigns in the financial sector.

What digital marketing services are typically offered for financial institutions?

Common services include , content marketing, social media management, PPC advertising, and email marketing tailored for financial services.

How do digital marketing agencies help financial institutions build trust and credibility?

They establish trust through client testimonials, industry partnerships, transparent practices, and ethical approaches to marketing, showcasing credibility to potential clients.